The Impact of Volatility on Investment Outcomes

An Obsiido Educational Insight

Disclaimer: This article is only intended to provide you with general information. It is neither an offer to sell nor a solicitation of an offer to purchase any security and does not constitute, and should not be construed as, investment advice. Any statement about a particular investment or company is not an endorsement or recommendation to buy or sell any such security. The article is not intended to provide legal, accounting, financial or tax advice, and should not be relied upon in that regard. You are encouraged to seek independent advice. Every effort has been made to ensure that the article is accurate as of the date of first publication; however, we cannot guarantee that it is accurate, complete, or current at all times. The article may contain forward-looking information that reflects our current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties, and assumptions that could cause actual results to differ materially from those expressed herein.

In investing, compounding is your best friend. It’s the technical term for how your money makes you more money over time (for more on compounding click here for an awesome piece by ELLEVEST, a US personal finance fintech). It’s salso a way to evaluate the merits of different approaches to selecting and constructing investment portfolios. In order to figure out which investments may offer the highest probability of achieving future growth, retail investors typically review historical average returns and then try to determine whether future expected returns will be higher, lower or the same. What retail investors don’t typically consider is the volatility (or variability) of returns and the impact volatility has on how investment returns compound over time.

Volatility, in the context of investment returns, is the range of price changes an investment can experience over a period of time. If an investment’s price stays within a reasonable expected range, it is considered to be a lower volatility investment versus an investment that may experience a wide range of price changes over time

The best way to understand the impact of volatility on the compounding of returns is to explore a simplified example.

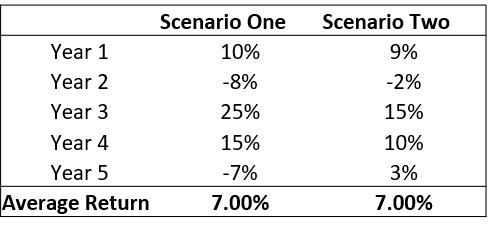

Let’s consider two scenarios. Captured in the table below are two hypothetical investments and their respective annual returns for a five year period. In both cases the average (arithmetic) return is the same, however, the annual returns experienced by each investment differ substantially.

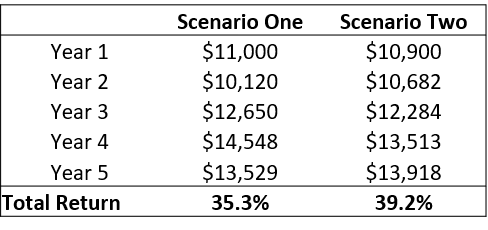

Now assume we invested $10,000 at the start of Year 1 and made no follow-on investments over time. Let’s see how the $10,000 grows in each scenario:

Scenario Two is the clear winner here. As result of less volatile returns, the $10,000 invested in Scenario Two compounded at a higher rate over the 5 year period when compared to Scenario One. Even if the yearly returns in Scenario 2 were slightly lower, you would still likely come out ahead in Scenario Two due to the power of compounding with lower return volatility/variability over time.

The challenge than becomes how do you build a less volatile investment portfolio that produces the same average return, over time, when compared to a more volatile investment portfolio. Conventional wisdom suggests this isn’t possible as higher returns are only possible by taking on more risk. In traditional portfolios (only stocks and bonds), volatility is reduced by pairing stock exposure with bond exposure. As bonds are less volatile (have more price certainty), they help to reduce overall portfolio return volatility but at a cost. The cost is a reduced expected return as bonds offer substantially lower returns, on average, compared to stocks.

This is where alternative investments come in. By replacing some exposure to traditional stocks/bonds with high quality alternative investments, you may be able to reduce portfolio volatility (i.e. increase the certainty of your expected returns) without a substantial reduction in expected returns. This will allow you to compound returns at a higher rate over time.

As famed hedge fund investor, Ray Dalio, wrote in his book, Principles, “With fifteen to twenty good, uncorrelated return streams, you can dramatically reduce your risks without reducing your expected returns.”