There is fundamental change underway in global capital formation and allocation. While public markets continue to anchor global capital markets, private markets have rapidly risen in importance. According to recent research, 87% of US companies with revenues in excess of $100 Million per year are privately held1. For investors, this means that substantial investment opportunities reside outside of public markets and span a variety of risk and return characteristics. These investment opportunities typically have lower correlations to public markets, thereby providing investors with valuable diversification benefits.

1Source: Capital IQ as of January 2022

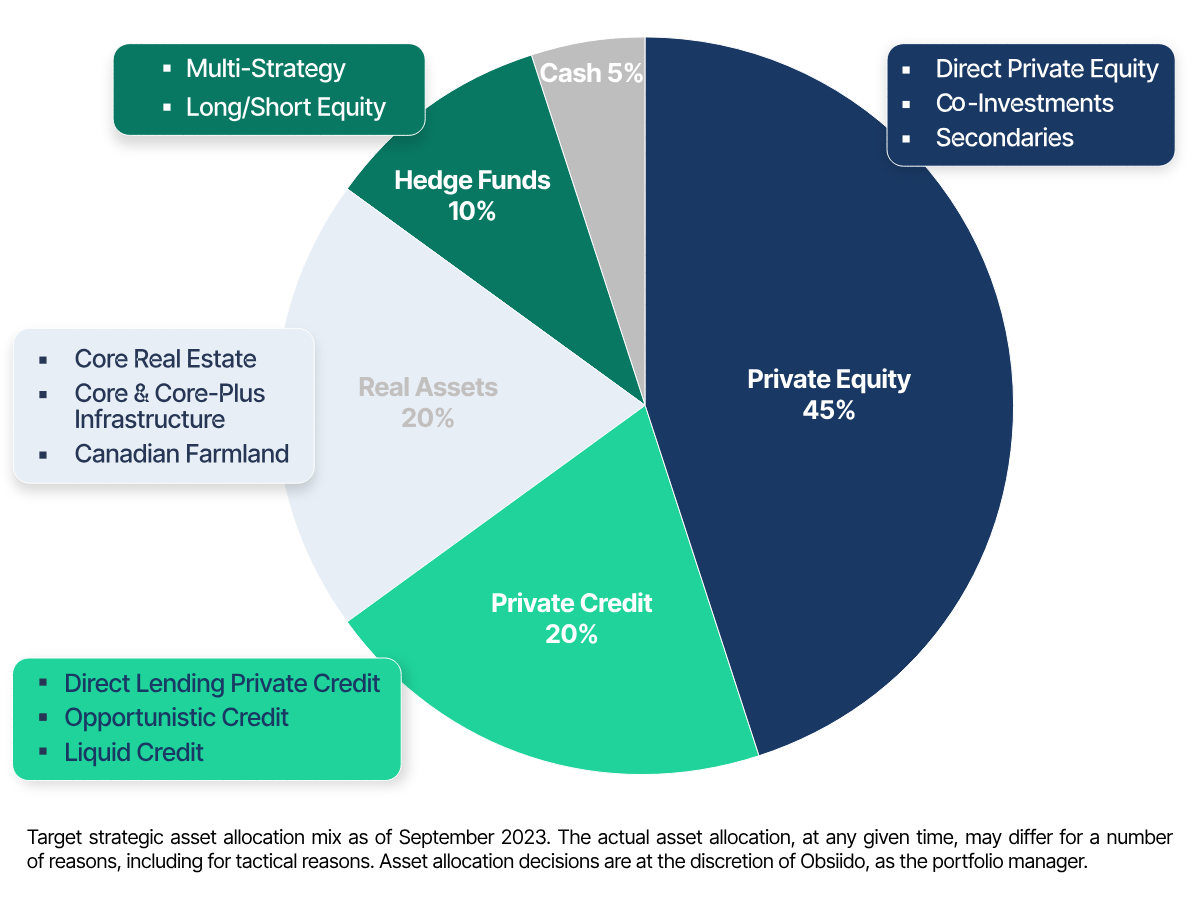

Obsiido Alternative Growth Portfolio has been built to provide a single solution to access a variety of private and alternative investment opportunities. Hear from our CIO, Sean O’Hara, as he shares more details about this Portfolio.

The Obsiido Portfolios are available only to Canadian residents who qualify under the “accredited investor” exemption pursuant to National Instrument 45-106 Prospectus Exemptions (“NI 45-106”) or, if residing in Ontario, section 73.3 of the Securities Act (Ontario) (“OSA”). Please refer to NI 45-106 or the OSA for more information regarding the availability of this exemption.

Investments in private securities involve risks, including potential loss of capital, and are intended for individuals or entities with the financial knowledge and capacity to bear such risks. The content provided does not constitute financial, legal, or tax advice. Please consult with your professional advisors before making any investment decisions.

The offering of units of the Obsiido Portfolios is made pursuant to their respective offering documents and only to investors in certain jurisdictions of Canada who meet certain eligibility requirements. Please read the offering documents carefully before investing.

By proceeding, you confirm that you meet these eligibility criteria and understand that the investment opportunities presented may not be suitable for all investors.