Finding (Alternative) Income

A Private Debt Primer

Disclaimer: This article is only intended to provide you with general information. It is neither an offer to sell nor a solicitation of an offer to purchase any security and does not constitute, and should not be construed as, investment advice. Any statement about a particular investment or company is not an endorsement or recommendation to buy or sell any such security. The article is not intended to provide legal, accounting, financial or tax advice, and should not be relied upon in that regard. You are encouraged to seek independent advice. Every effort has been made to ensure that the article is accurate as of the date of first publication; however, we cannot guarantee that it is accurate, complete, or current at all times. The article may contain forward-looking information that reflects our current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties, and assumptions that could cause actual results to differ materially from those expressed herein.

A few days ago, I was chatting with a friend who was telling me about an alternative investment that she had recently initiated. The investment was a private loan through which she had lent $100,000 to someone in exchange for a 10% annual interest rate, payable monthly. The loan was secured (collateralized) against the borrower’s home (first position) and the borrower had to cover the cost of insurance taken out against the value of the loan. She had made the investment through a third party who specialized in sourcing, structuring and administrating private lending opportunities. All said, a 10% rate of return on an asset backed lending opportunity is pretty attractive when compared to other income oriented investments. Today, a 12 month non-redeemable GIC will get you as much as ~4%, a high interest savings account or ETF might get you ~3%, and publicly listed income oriented securities might get you between 2%-10% annually but with added price volatility.

The investment opportunity my friend stepped into is an example of a (direct lending) private credit transaction. In the world of investing, private credit is big business but not something most retail investors are aware of. Previously, I’ve written about private equity and how it has generated attractive returns for institutions and wealthy investors for decades. Private credit has played a huge role in the success of private equity and is increasingly an asset class being favored by sophisticated investors.

Private credit can be defined as any non-bank lending activity. It includes loans from private lenders to corporations, loans from private lenders to individuals, loans from individuals to other individuals and everything in between. Basically, if the loan isn’t being extended by a bank, it’s considered to be private credit.

Private credit has existed since the dawn of time. Before banks, private individuals/firms extended loans to each other in exchange for rates of return. The concept of lending to earn a return is not new, however, private credit’s maturation as an investable asset class is. An investable asset class can be defined by a common set of characteristics that give large, sophisticated investors comfort and security when investing. Unfortunately, most retail investors are unaware of these considerations, which can, and do, result in being caught up in sub-optimal investing situations. Some of the characteristics of investable asset classes include:

- The size of the asset class (total assets, # of active participants, # of markets, trading volumes, sources of liquidity)

- Regulatory oversight of the asset class to ensure activities are legal and bad actors are exposed and removed from the ecosystem

- The quality and track records of personnel operating investment funds and strategies within the asset class

- Standardized valuations that adhere to industry best practices (preferably with an independent third party validating/carrying out the valuations)

- Availability of accurate and standardized reporting (audited financial statements, performance reporting, tax reporting, commentary on performance)

- Use of high quality service providers for activities such as custody of assets, banking, legal advice, fund administration, tax advice, etc.

Basically, the more a given asset class matures, the more the above characteristics are adopted, the more willing large, institutional and professional investors are to invest in the asset class. For private credit, this maturation hit stride following the global financial crisis as a surge in demand for high yielding investments drove more interest and assets into the space.

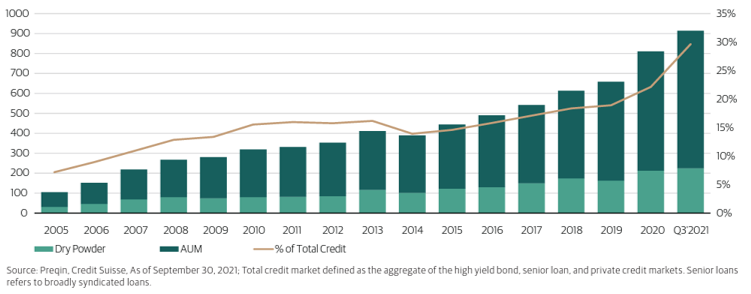

According to leading alternative investments firm, Blackstone, private credit now accounts for over $1 Trillion USD in assets, tripling in size since 2008 driven by substantial institutional investor interest

What is Private Credit?

As mentioned above, private credit, simply put, is any non-bank lending activity. However, within the investment industry, private credit excludes things like non-bank mortgage lending and peer-to-peer lending activity. For the purposes of this post, and to keep things simple, I’m going to use the generally accepted definition for private credit, which is loans initiated by private firms (typically investment funds) to borrowers that include both public and private businesses. Historically, private credit loans largely focused on lending to small and medium sized businesses, that had difficulty accessing capital from traditional sources such as banks. Now however, private credit loans are being extended to companies of all size. In fact, in many regions, private credit providers are competing head to head with banks for lending opportunities to the largest companies in the world.

Before we go any further, some important definitions:

Sponsor Backed Lending: Private credit transactions where the lending firm provides a loan to a company (the borrower) that is being backed by a private equity firm. Sponsor-backed lending is the largest segment of the private credit market

Non-Sponsor Backed Lending: Private credit transactions where the lending firm provides a loan to a company (the borrower) that is not being backed by a private equity firm

Asset Based Lending: Private credit transactions where the loan is secured by an asset, which is typically worth more than the value of the loan. In the event the borrower doesn’t pay back the loan, the lender has rights over the borrower’s asset

Non-Asset Based Lending: Private credit transactions where the loan is not secured by an asset also known as unsecured lending. Not a common approach in the private credit market

Loan Covenants: Pre-defined promises or conditions that a borrower has to abide by if they enter into an agreement to borrow funds. Covenants are an important aspect of any lending arrangement and provide lenders additional security when entering into a lending arrangement with a borrower

Underwriting: The process by which a lender assesses the risks associated with lending capital to a given borrower in order to determine things like what rate of return they may need to off-set the risk and whether or not to even lend capital in the first place. Basically determining whether a borrower is credit-worthy or not

All of the above will help you understand and assess the world of private credit and to ultimately become a more informed investor.

Why You Should Care About Private Credit

Okay, so now you know a little bit about what private credit is, it’s growth rate and that there is a lot of demand for private credit from sophisticated investors. That’s all great but why should you care? Simply put, private credit investments can provide greater yields and overall returns when compared to other kinds of credit oriented investment offerings. Before we jump into a review of historical and forward looking risk/returns, an important note about the risks of investing in private credit.

Private Credit Risks

Default Risk: The primary risk in any kind of lending transaction is whether the borrower will repay the loan. The technical term for this risk is default risk and it’s a really important concept to understand. If a borrower defaults on a loan, it’s important to understand what options the lender has to recover the loan and, in many cases, what options the lender has to penalize the borrower in order to recover any interest payments owed as well as the time, money and effort required in the recovery process. The best private credit lenders in the world have extensive experience in dealing with default situations, which require significant legal and corporate finance expertise. According to international law firm, Proskauer, which produces a quarterly private credit default index, specifically for US private credit loans, the overall default rate for US private credit loans (893 loans reviewed) was 1.12% for the quarter ended March 31st, 2022. This compares to a default rate of 0.4% for US High Yield Loans for the same period per a recent report from ratings agency, Fitch.

Liquidity Risk: Like private equity, private credit, as an asset class, is less liquid when compared to publicly traded credit securities. Investors in private credit investments should be comfortable with longer investment time horizons (usually 12 months or more) and the inability to redeem their invested capital on demand. In exchange for bearing liquidity risk, investors are usually compensated with higher returns when compared to equivalent publicly traded investments

With that in mind, let’s look at historical and forward looking returns from private credit and other fixed income asset classes.

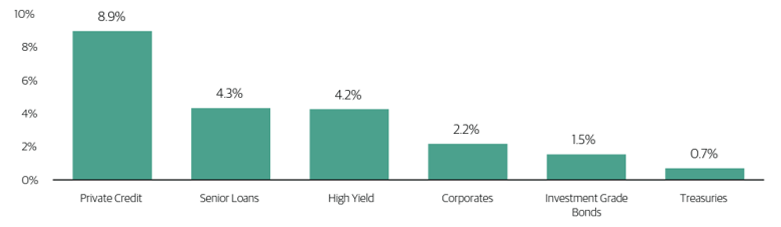

The chart above, sourced from a recent Blackstone report plots the annualized risk/return of various fixed income asset classes for a 15 year period ended December 31st 2021. Private Credit has clearly outperformed other fixed income asset classes generating a return in excess of 8% annualized.

Most of the return from private credit investments (if not all) comes from monthly or quarterly interest payments, otherwise known as yield.

The chart above, also sourced from a recent Blackstone report, shows recent yields of private credit relative to other fixed income asset classes. A fairly one sided comparison.

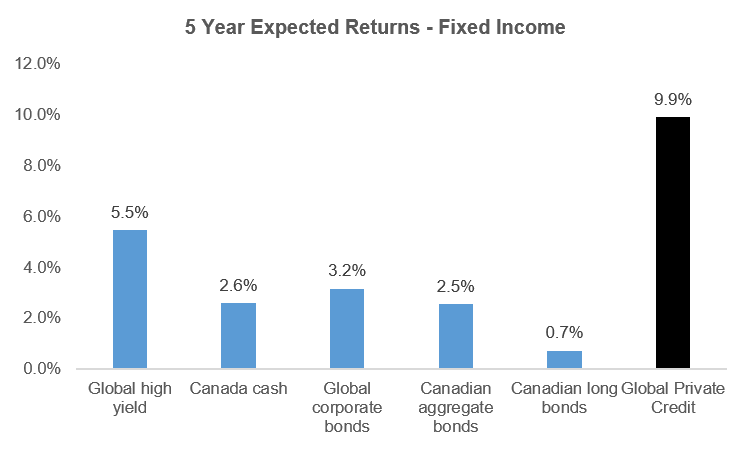

Finally, looking ahead, and using forward looking asset class returns sourced from the BlackRock Investment Institute, we can see that private credit is expected to continue to generate ‘equity like’ performance, which is a core reason why sophisticated investors continue to allocate to the asset class.

In Summary

To sum up, private credit is a growing alternative asset class that has generated attractive historical performance and is expected to continue to perform well over the next several years. The vast majority of returns within private credit come in the form of yield or interest payments, which make it an attractive investment for investors looking for high yield or cash flow generating investments.