Understanding Hedge Funds

Understanding Hedge Funds

Hedge funds are specialized actively managed private investment vehicles. The first hedge fund dates back to the 1940s, but it wasn’t until the 1990s when hedge funds took off. These investments initially focused on providing investors a means to “hedge” equity market risks but today, hedge funds execute complex investment strategies that use leverage, short selling, and other sophisticated investing techniques.

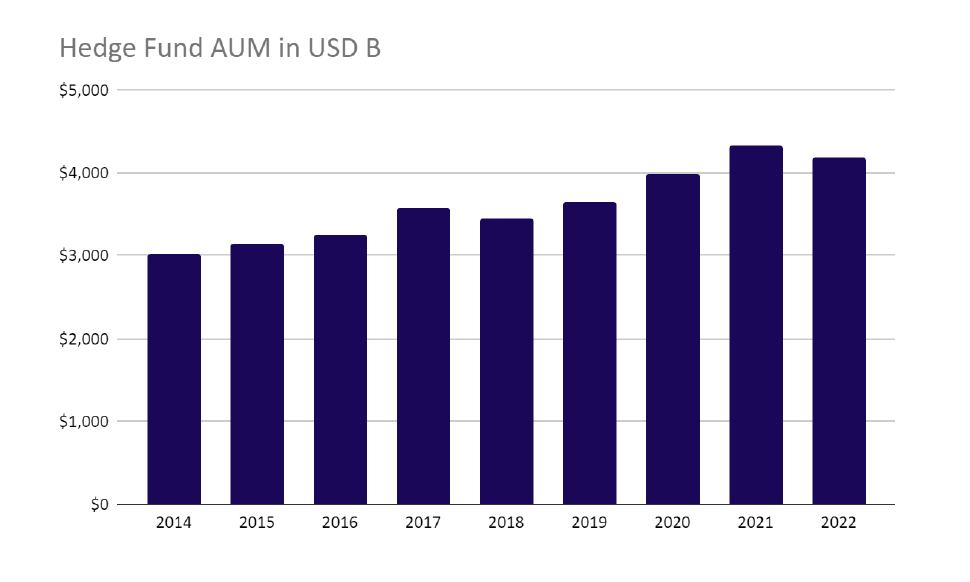

As of Q4 2022, hedge fund AUM totaled $4.1 Trillion USD and grew at a 4.2% CAGR between 2014 and 2022.1

Exhibit 1: Hedge Fund AUM Over Time2

What’s So Great About Hedge Funds?

Hedge funds include a wide array of investment strategies that seek to address a range of different investor objectives. They employ a flexible management style to earn risk-adjusted excess returns for their investors. Hedge fund strategies typically invest in liquid asset classes such as equities, bonds, currencies, and commodities. They may also choose to invest in less

liquid investments such as distressed securities. Hedge funds typically offer greater liquidity than do private market investments such as private equity or private debt.

The significant increase in hedge fund assets over the years is due to the following investment attributes:

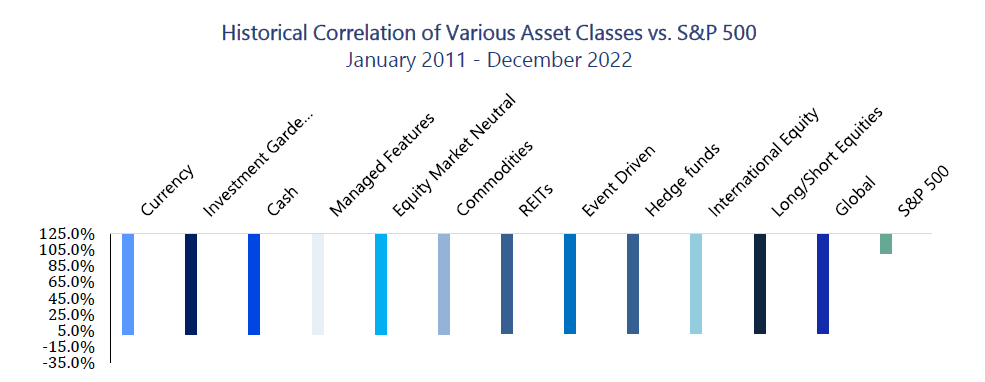

- Low levels of correlation with traditional asset investment returns.

- The potential to outperform traditional investments.

- Ability to hold both long and short positions in securities.

- Ability to apply leverage, use derivatives or utilize other investment instruments to implement their strategy.

It is important to note that the hedge fund asset class covers a wide variety of highly differentiated investment strategies that produce distinct risk/return outcomes for investors.

What are the Types of Hedge Funds?

There are several types of hedge funds. Some of the most common types of hedge funds include:

| Type | Description |

|---|---|

| Long/Short Equity | Invests in both long and short positions in individual stocks, with the goal of generating returns from both the long and short side of the market |

| Macro | Focused on macroeconomic trends and global economic events, such as changes in interest rates, currency fluctuations, and political events |

| Event Driven | Explores companies that are undergoing significant corporate events, such as mergers and acquisitions, bankruptcies, or restructurings. Activist investing typically falls under the Event Driven category |

| Distressed | Specializes in companies experiencing financial distress, with the aim of making a profit by buying their debt at a discount and either holding it until maturity or selling it for a profit |

How Will Hedge Funds Help My Portfolio?

Diversification and Volatility Reduction

Hedge funds can provide diversification benefits to an investment portfolio, as they pursue investment strategies that are typically differentiated from the public market. This can help to reduce overall portfolio risk and potentially enhance risk adjusted returns.

As a category, hedge funds have a high correlation to broad market indices like the S&P 500 (0.75- high positive correlation). but different strategies can deliver higher diversification benefits.

Exhibit 2: Hedge Fund Diversification Benefits3

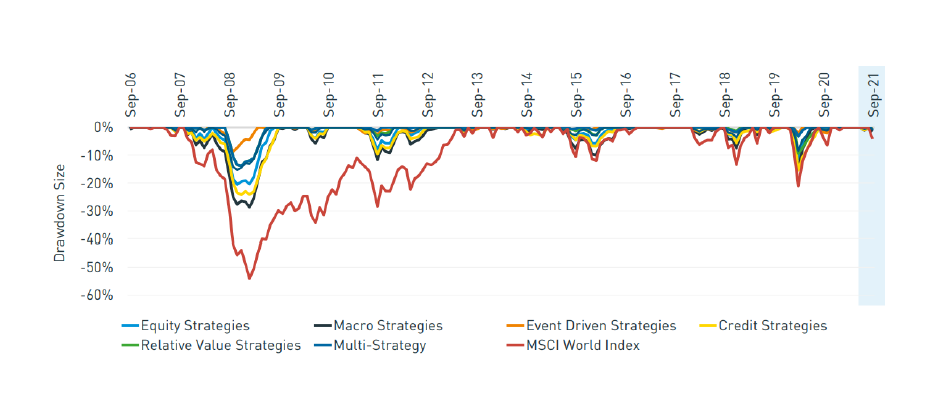

Hedge funds also have a long track record of reducing portfolio drawdowns and price volatility vs the market as illustrated in the following chart.

Exhibit 3: Hedge Fund Drawdown Protection History4

Exhibit 4: Hedge Volatility, Maximum Drawdowns, and a Sharpe Ratios vs the MSCI World Index and a Traditional 60/40 Portfolio5

| 5 Year | 10 Year | |||||

|---|---|---|---|---|---|---|

| All Hedge Funds | 60/40 Portfolio | MSCI World Index | All Hedge Funds | 60/40 Portfolio | MSCI World Index | |

| Volatility | 7.56% | 9.09% | 14.81% | 6.28% | 8.20% | 13.43% |

| Max Drawdown | -11.23% | -13.30% | -21.05% | -11.23% | -13.30% | -21.05% |

| Sharpe Ratio | 1.28 | 2.19 | 0.85 | 1.43 | 1.04 | 0.90 |

Higher Risk Adjusted Returns

Hedge funds may have started as a way for managing risk, but they quickly started becoming known for generating substantially higher returns than the market. This was particularly true in the 1990s where “Star” hedge fund managers began to emerge.

The last decade, however, has not been as positive for hedge funds vs the market. Since the GFC (Great Financial Crisis), hedge funds have been more beneficial for those who want to diversify, reduce risk, and reduce volatility.

Exhibit 5: Hedge Fund Returns vs the MSCI World Index and a Traditional 60/40 Portfolio6

| 5 Year | 10 Year | |||||

|---|---|---|---|---|---|---|

| All Hedge Funds | 60/40 Portfolio | MSCI World Index | All Hedge Funds | 60/40 Portfolio | MSCI World Index | |

| Annualized Returns | 10.77% | 9.01% | 13.74% | 9.57% | 9.10% | 12.68% |

Risks and Considerations

Below we describe a variety of risks that investors should take into consideration when evaluating investment strategies that fall under the hedge fund asset class:

- Complexity Risk: Hedge fund strategies are typically quite complex often employing sophisticated trading and investing strategies that may be difficult to understand

- Manager Risk: Due to the substantial disparity in performance from one hedge fund strategy to another, it is important to identify and invest with hedge fund managers with proven track records and repeatable investment processes

- Leverage Risk: Most hedge fund strategies employ some form of leverage, which may increase the risk of the overall strategy

- Liquidity Risk: While most hedge funds invest in liquid markets (stocks, bonds, commodities, currencies), they may be structured to only allow investors to redeem their invested capital at pre-determined periods (e.g., weekly, monthly, or less frequently)

- Fees & Expenses: Like other alternative investments, hedge fund strategies usually carry two layers of fees including an ongoing management fee (usually between 1%-2% of assets) and a performance fee (usually between 10%-20%), which typically kicks in if the hedge fund delivers a certain performance return (hurdle rate)

1Preqin, as of December 2022.

2Preqin, as of December 2022.

3Guggenheim, “Asset Correlation Map,” as of January 2011 to December 2022.

4Preqin, as of September 2021.

5Preqin, as of January 2022. “Preqin 2022 Global Hedge Fund Report.”

6Preqin, as of January 2022. “Preqin 2022 Global Hedge Fund Report.”