A substantial portion of the alternative investments universe produces regular cash flows that can compliment yield oriented public market investment opportunities. Private debt has become increasingly relevant as a source of debt capital for a growing portion of the overall economy. Private real assets such as real estate, farmland and infrastructure can produce stable yields while preserving the value of invested capital over time. These cash flow generating alternative investments, in certain cases, have limited relationships with public market income producing securities, which provides investors with important portfolio diversification benefits.

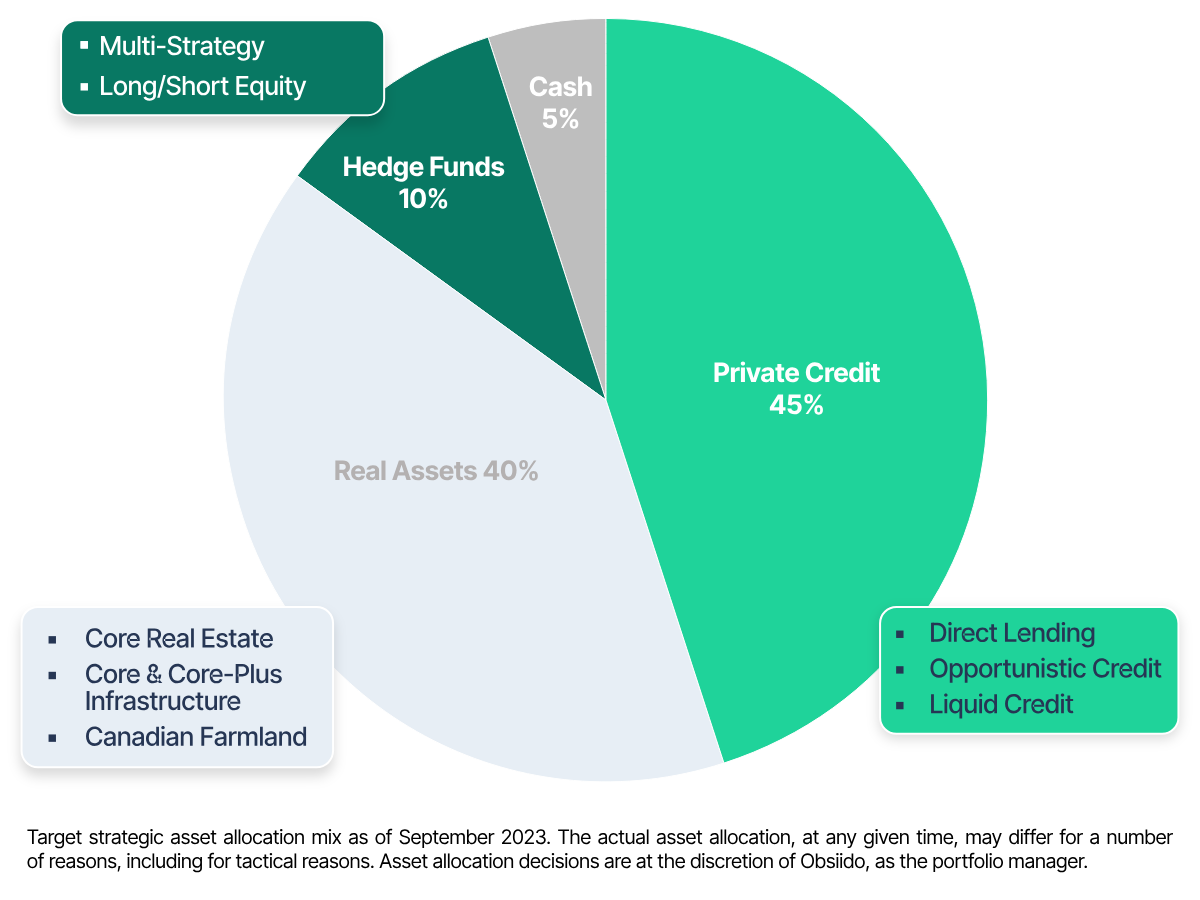

Obsiido Alternative Income Portfolio has been built to provide a single solution to access a variety of private and alternative investment opportunities with an emphasis on asset classes and strategies that generate stable, recurring cash flows. Hear from our CIO, Sean O’Hara to learn more about this portfolio.

The Obsiido Portfolios are available only to Canadian residents who qualify under the “accredited investor” exemption pursuant to National Instrument 45-106 Prospectus Exemptions (“NI 45-106”) or, if residing in Ontario, section 73.3 of the Securities Act (Ontario) (“OSA”). Please refer to NI 45-106 or the OSA for more information regarding the availability of this exemption.

Investments in private securities involve risks, including potential loss of capital, and are intended for individuals or entities with the financial knowledge and capacity to bear such risks. The content provided does not constitute financial, legal, or tax advice. Please consult with your professional advisors before making any investment decisions.

The offering of units of the Obsiido Portfolios is made pursuant to their respective offering documents and only to investors in certain jurisdictions of Canada who meet certain eligibility requirements. Please read the offering documents carefully before investing.

By proceeding, you confirm that you meet these eligibility criteria and understand that the investment opportunities presented may not be suitable for all investors.